The PPP for Bloggers, Podcasters, and Other Self-Employed Online Business Owners

The CARES Act created a wonderful opportunity for businesses struggling because of COVID-19. That opportunity is through the PPP or Paycheck Protection Program. This post will talk about the PPP for bloggers, podcasters, and other self-employed individuals doing business online.

Note: This is ever-changing! There are several different interpretations of the PPP and I will continue to update this post as much as I can.

An explanation of what the Paycheck Protection Program is, in 15 seconds

The PPP is a loan program through the SBA. It was created as part of the CARES act for businesses adversely affected by COVID-19. (And really, what business isn't, aside from maybe Zoom and the grocery industry?)

What it means when people say this is "free money"

I repeat, this is a loan program. But, it's a loan you don't have to pay back...so long as you use the funds for certain specific things, like payroll expenses. Hence, free money.

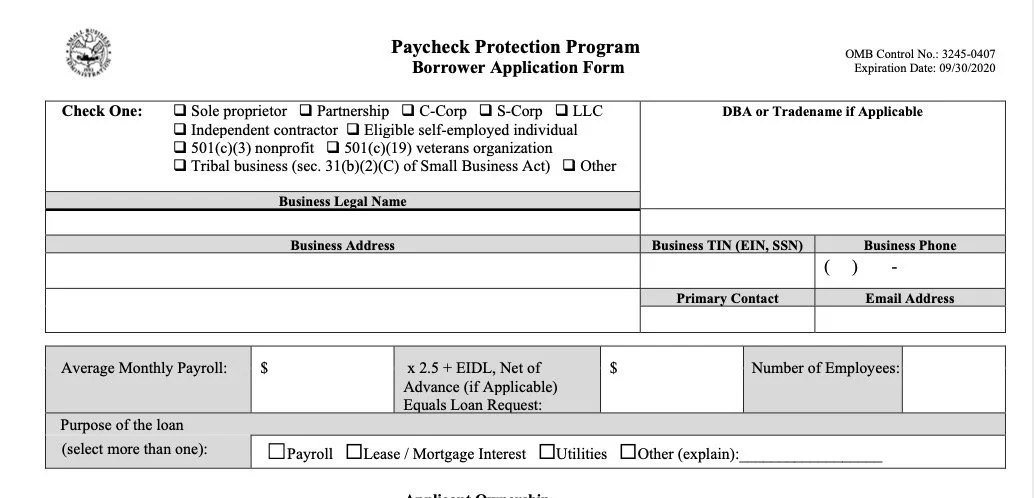

Snapshot of the PPP application. Access the full application here.

Are bloggers, podcasters, and self-employed business owners eligible for the PPP?

Short answer: Probably.

Long answer: So long as you meet the following requirements, which you'll have to sign off on when applying for the loan.

Less than 500 employees (with some exceptions that probably don't apply to bloggers and podcasters);

In operation as of February 15, 2020;

Current economic uncertainty makes the funds necessary to support your ongoing business operations;

Funds must be used to retain workers and maintain payroll, OR make mortgage interest payments, lease payments, and utility payments;

You haven't received another PPP loan; and

You had employees whom you paid salaries and payroll taxes OR paid independent contractors.

So that last one, #6, is the kicker.

Technically, if you're a single-member LLC, you don't pay yourself a salary or issue yourself a 1099. So the big, bad question that no one has made crystal clear yet is, does a draw paid to yourself, as a self-employed person, count as a salary or wages for PPP purposes?

We know that expenses you incur to pay any employees definitely count.

The PPP application itself says:

With respect to “purpose of the loan,” payroll costs consist of compensation to employees (whose principal place of residence is the United States) in the form of salary, wages, commissions, or similar compensation; cash tips or the equivalent (based on employer records of past tips or, in the absence of such records, a reasonable, good-faith employer estimate of such tips); payment for vacation, parental, family, medical, or sick leave; allowance for separation or dismissal; payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums, and retirement; payment of state and local taxes assessed on compensation of employees; and for an independent contractor or sole proprietor, wage, commissions, income, or net earnings from self-employmentor similar compensation

So, based on what we're told from the application, these things probably count, too:

A monthly draw you give yourself from your LLC

Wages you earn from self-employment

How much money can you get from the PPP?

Here's the simplest way to make that calculation if you are a sole prop or LLC that files a Schedule C along with your income taxes:

Get out your 2019 return (your 2018 return is PROBABLY ok if you haven't filed for 2019 yet, but they haven't explicitly stated that the 2018 return is ok, just FYI).

Flip back to your Schedule C from your business.

Look at line 31. Divide that number by 12. That's your average monthly payroll amount! Now multiply that by 2.5, and that's the amount that you can ask for.

When bloggers, podcasters, and other self-employed online business owners can apply for PPP

Now. Like, RIGHT NOW.

Technically, "small businesses and sole proprietorships" can apply as of April 3, 2020. "independent contractors and self-employed individuals" can apply as of April 10, 2020. This is about as clear as mud, because you can be self-employed, and a sole prop. Or an independent contractor, and a sole-prop. Or a small business, and self-employed. So I repeat, if you think you qualify, just log into your bank and apply now.

Because the thing with this loan is that it's only available until they run out of the funds earmarked for it. 10% of the entire amount earmarked has already been applied-for.

Not trying to instill panic, here. Just want you to shake a leg and apply if you are eligible!